By presenting a detailed case study, which focuses on who gets subjected to government liens, this essay helps U.S. states to make more informed decisions. It seeks to do so by critically assessing Illinois’ historic approach to lien imposition and enforcement, in part, because this state had the most forced sales of real property in recent years. In addition, Illinois also generated the largest amount of related economic losses in the U.S. during that same time period. This state did so despite adhering to the old majority rule for turning over surplus value from such sales. That rule required creditors to return any surplus to debtors, at least in cases wherein 1) a sale is final, 2) creditors are made whole and 3) debtors do what is legally required to receive the money that is left over after foreclosure. This rule is now the only possible one after the U.S. Supreme Court’s Tyler v. Hennepin County decision.

My essay carries out the aforementioned research in its seven (7) parts (I-VII). Part I is the introduction. Part II provides some basic background information about government liens, which highlights how these encumbrances are imposed in Illinois. Part III describes the applicable law in the wake of Tyler. Part IV outlines this essay’s approach to collecting and analyzing government lien data. Parts V contains its analysis of these data, which finds that firsthand observations about a debtor’s conduct may be a better basis for making government lien imposition decisions than relying on projections that employ secondhand information. Part VI contains the essay’s recommendations, including one about how creditor-states may limit right violations by requiring perfect equality of treatment with respect to how liens are imposed and/or enforced against similarly situated debtor-citizens. Part VII is the conclusion.

I. Introduction

After failing to pay Hennepin County property taxes between Fiscal Years 2010 and 2015, which generated a Minnesota state debt of $15,000, Geraldine Tyler had a government lien imposed on her condominium.1 Tyler failed to settle this debt, even after several requests for payment, which led Hennepin County to perfect and enforce its lien against the condominium.2 A foreclosure sale was held, in relatively short order, which allowed Hennepin County to fully recover from Tyler.3 But, instead of turning over the surplus, which was the difference between the condominium’s $40,000 sale price and what Tyler owed the state, Hennepin County kept the entire $25,000 profit.4

In a subsequent lawsuit,5 Tyler asserted that her federal constitutional rights had been violated by Hennepin County’s seizure of the $25,000 in surplus value.6 Tyler’s theory of the case was that Hennepin County’s failure to turn over any of the $25,000 constituted an actionable violation of the Fifth and Eighth Amendments of the U.S. Constitution.7 The federal courts, at least initially, did not find Tyler’s claims to be compelling, especially since it was unclear if federal or state law has ever recognized any such property right.8

The U.S. Supreme Court, however, proved to be a more sympathetic audience.9 Chief Justice John Roberts, who wrote on behalf of the full Court, found that “Tyler has plausibly alleged … [that Hennepin County took her property within the meaning of] … the Fifth Amendment … [so] … we need not decide whether she has also alleged an excessive fine under the Eighth Amendment.”10 In other words, Hennepin County and several other U.S. sub-national governments can no longer “use the toehold of the tax debt to confiscate more property than … [is] … due” as “Tyler has stated a … [valid] … claim under the Takings Clause and is entitled to just compensation.”11

Tyler v. Hennepin County, among other recent controversies, underscores the need for more research on government liens.12 Such research may have implications for creditor-states and debtor-citizens alike, especially if it asks and answers certain questions.13 An example of such a question is “how can U.S. states make better lien imposition decisions, including in subnational jurisdictions that are more conventional than Minnesota, so as to avoid federal constitutional claims under the Fifth or Eighth Amendments?”14

By presenting a detailed case study, which focuses on who gets subjected to liens in a more legally conventional jurisdiction than Minnesota, this essay could help a range of U.S. governments to make more informed decisions.15 It seeks to do so by critically assessing Illinois’ approach to lien imposition and enforcement, in part, because this jurisdiction had the most forced sales of real estate between 2014 and 2021. In addition, this state also generated the largest amount of economic losses from such sales during the same period.16 Illinois did so despite adhering to the majority legal rule.17 That rule requires creditors to return all surplus value to debtor-citizens, at least in cases wherein: (1) a sale is final, (2) the creditor-state, or its assignee, is made whole and (3) the debtor does what is required to get the surplus.18

This essay carries out the aforementioned research in its six (6) additional parts (II-VII). Part II provides information about government liens in Illinois, which highlights how these types of encumbrances are imposed and enforced in a typical U.S. state. Part III describes the applicable law in Illinois. Part IV outlines this essay’s approach to analyzing government lien data. Part V analyzes the lien data and asserts that firsthand observations about a debtor’s conduct would be a better basis for making a lien imposition decision than relying on projections that use secondhand information. Part VI contains the essay’s recommendations, including one about how creditor-states may limit constitutional violations by requiring perfect equality of treatment with respect to how government liens are imposed on, and enforced against, similarly situated debtor-citizens. Part VII is the essay’s conclusion.

II. Issues Presented

A lien, by definition, is the legal right to take possession of another’s property until their payment obligations are fully discharged.19 Under the laws that govern liens in Illinois, which may be implicated whenever a sub-national government is owed taxes or fees by an in-state property owner, debtors must pay what is owed to their creditor: in order to avoid a legal challenge to their ownership interests.20 And in cases wherein a debtor-citizen still does not pay the creditor-government after their property is properly encumbered by a state lien,21 then a creditor-state gains a legal right to take possession of a debtor-citizen’s property and sell it via a foreclosure sale.22

Alternately, the creditor-state may assign its legal right to foreclose to an unrelated third party in exchange for some valuable consideration.23 There are at least two valid ways of carrying out such an assignment under Illinois law.24 The first option, which is called the Annual Tax Sale, applies to properties with delinquent “taxes for the immediately preceding tax year.”25 The second method, which is referred to as the Scavenger Sale, applies to any property with “delinquencies of three or more years that were not purchased . . . [during Illinois’ Annual Tax Sale or another valid dispensation option].”26

Unfortunately, a series of recent articles find that similarly situated debtors may be treated in non-standard ways without adequate justification.27 Such unequal treatment is not only unfortunate, but it also potentially violates the federal constitution in a different way than was alleged in the Tyler case.28 Thus, it should be avoided to limit the risk of Equal Protection violations.29

In a related matter, “what explains the unequal treatment of certain similarly situated debtor-citizens?”30 One possible explanation for less than standard treatment, at least as between individual and business debtors,31 is that Illinois may be reticent to impose government liens on more politically organized groups, such as business debtors. In contrast, this state may not have any such concerns about encumbering the properties of much less politically organized groups like individual debtors.32 Any such disparity cannot be justified for several reasons, including the fact it may give rise to litigation in more complex factual situations than what is described in Tyler.33

Less than standard treatment of otherwise similarly situated debtor-citizens, in other words, should be a serious concern for Illinois.34 Especially as it increases the risk of unjustified violations of the Fifth and/or Fourteenth Amendments by this already cash-strapped state.35 As such, it is important to find out which debtors get treated better and under what specific conditions.36 This essay answers the first of these questions, at least for a subset of debtors (individual and business ones) at two sub-national levels (U.S. state and county) and during a limited timeframe (1994-2020). It does so, primarily, by making use of a newly released Department of Revenue (DOR) dataset.37

This narrow research focus is appropriate, as it builds on previous scholarly work that does distributional analyses of U.S. public goods and services.38 Many of these analyses underscore the need for more focused research questions whose answers retain high levels of explanatory power, ideally by employing easy-to-understand methodological approaches.39 The idea is that such analysis could help government officials, their staffs and the general public better understand existing sub-national policies and how each determines who gets what (i.e., the actual distribution of public benefits at the individual, household and/or group levels by U.S. governments).40 Any such analyses also may prove useful for understanding other jurisdictions.41

Although distributional analyses have numerous limitations, such as a modest ability to determine the direction or strength of any relationships between variables, they still have a role to play in evaluating policies.42 For example, distributional analyses may provide a simple way to test different null hypotheses.43 They also have the potential to show how public goods and services are distributed across space during a particular year and over time.44 Third, any such analyses may identify when similarly situated citizens are treated in non-standard ways without adequate justification.45 As such, this essay views the act of undertaking a distributional analysis as an important step in identifying the optimal basis for imposing government liens in Illinois.46

III. Applicable Law

Under the laws that authorize government liens in Illinois, which were recently updated by the 100th General Assembly, a creditor-state must take certain steps to legally encumber the real or personal property of a debtor-citizen.47 For example, usually through the recording of certain documents in their proper place, a creditor-state must notify its debtor-citizens about the existence of a delinquency and how their debt can be brought back into good standing.48 Once these requirements are met, the debtor-citizen is on notice about the amount that is needed to extinguish a creditor-state’s legal claims.49

In the event that a debtor-citizen does not pay in a timely manner, or fails to negotiate an extension, then a creditor-state may perfect its lien.50 The act of perfecting its lien gives a creditor-state the legal right to take possession of a debtor-citizen’s in-state property.51 Once its lien is perfected, and filed in state court, a creditor-state can file a motion for turnover or begin foreclosure proceedings.52 A motion for turnover transfers an encumbered property from the debtor-citizen to the creditor-state without the need for any adversarial proceedings.53 Whereas foreclosure, if all required elements are met, allows the creditor-state to take possession of a debtor-citizen’s in-state property.54 And, if the debt is not paid off or a settlement reached, sell it off.

The first requirement for foreclosure is the creditor-state must identify every third-party with a legal interest in the debtor-citizen’s encumbered property.55 The creditor-state also must make a good faith allegation, which is plausible on its face at the time of filing, indicating that it has the ability to satisfy each of the required elements of this cause of action.56 Third, relevant and probative information must be introduced into the record to support its earlier good-faith allegation.57 Examples of other additional requirements for foreclosure include information about the origin of this lien, the reasons for pursuing foreclosure, the reasons for requesting a forced sale, the reasons for requesting any costs, the original decision that led to imposition of the lien and what steps were taken by the plaintiff-creditor, defendant-debtor and other interested parties before, during and/or after filing for foreclosure.58

The debtor-citizen, or any other interested party, has thirty (30) days to respond to the creditor-state’s foreclosure action.59 Interested parties may respond merely by introducing evidence into the record that this creditor-state made a mistake, such as refusing to accept or acknowledge payments.60 Other valid defenses or privileges, such as lack of notice, also may be available.61

If the creditor-state prevails in its foreclosure action, then a judgment lien will be imposed in order to allow for sale of a debtor-citizen’s property.62 Foreclosure sales often are organized by the judgment lien holder, i.e., by the creditor-state rather than by a debtor-citizen, but are subject to some judicial oversight.63 A valid foreclosure sale must be advertised in certain ways, open to the general public, and be conspicuously carried out in some public place.64

Upon completion of a foreclosure sale, typically after payment is received in certified funds, the court exercising jurisdiction over the matter “will issue an order approving . . . [transfer of the previously-encumbered property to a bona fide purchaser for value] . . . and payment of all costs and expenses … [to the judgment lien holder].”65 Later, “the sheriff will . . . deliver a Certificate of Sale to the purchaser.”66 At this point, “the proceeds . . . [from the foreclosure sale are] . . . paid to . . . creditors in order of priority.”67 If “there is . . . money left over . . . [after the forced sale, at least in Illinois,] . . . it is returned to . . . [the debtor-citizen and the lien is fully extinguished].”68

It should be noted that each debtor-citizen that is taken out of possession by a government lien retains a right of redemption, even as against a bona fide purchaser for value.69 But, in cases wherein a debtor-citizen either has not exercised this right in a timely manner or does not satisfy all required elements to invoke it, the court will enter a final judgment.70 Such a judgment fully extinguishes the debtor-citizen’s right of redemption and eliminates any possibility that their foreclosed property could be recovered in the future.71

IV. Methodological Approach

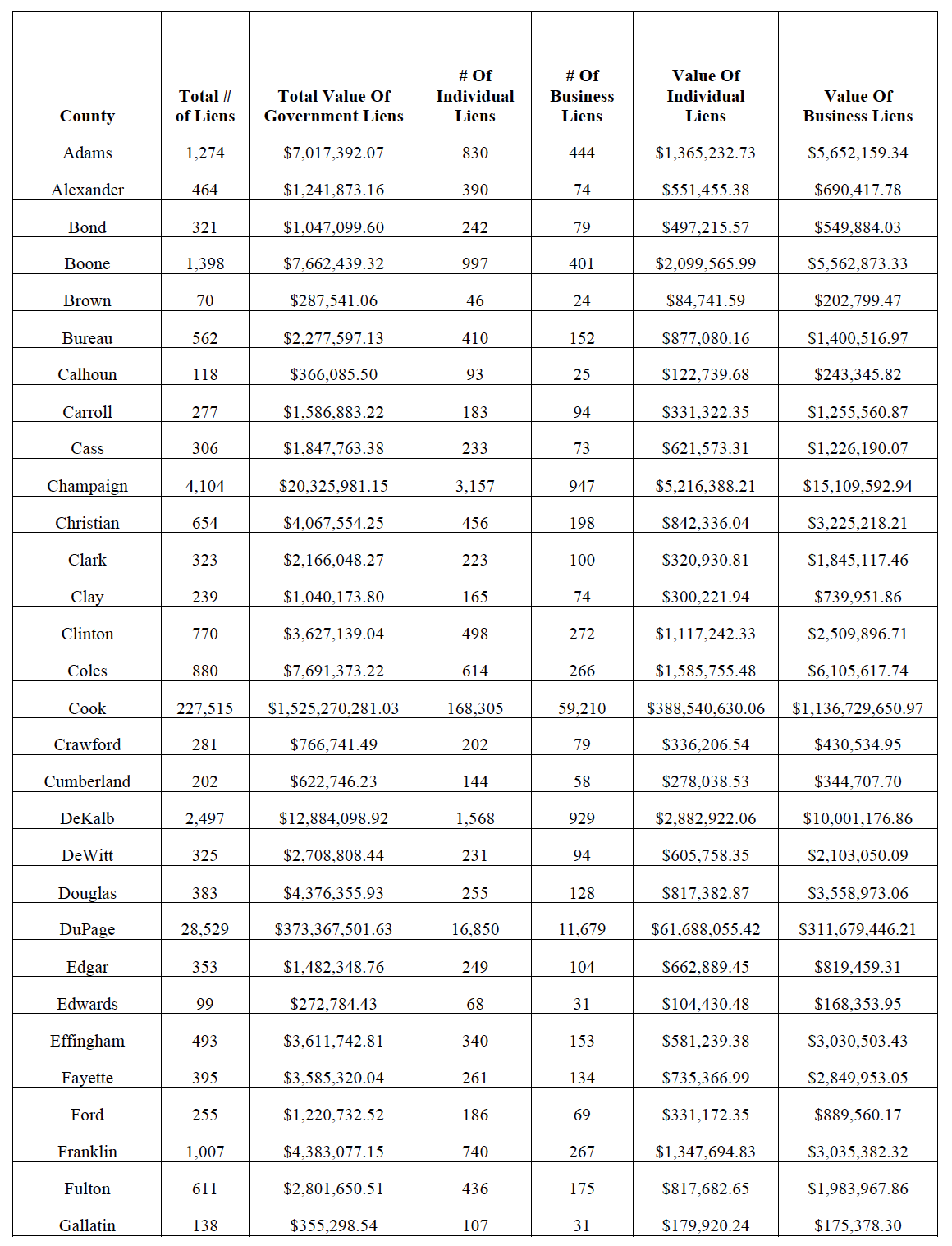

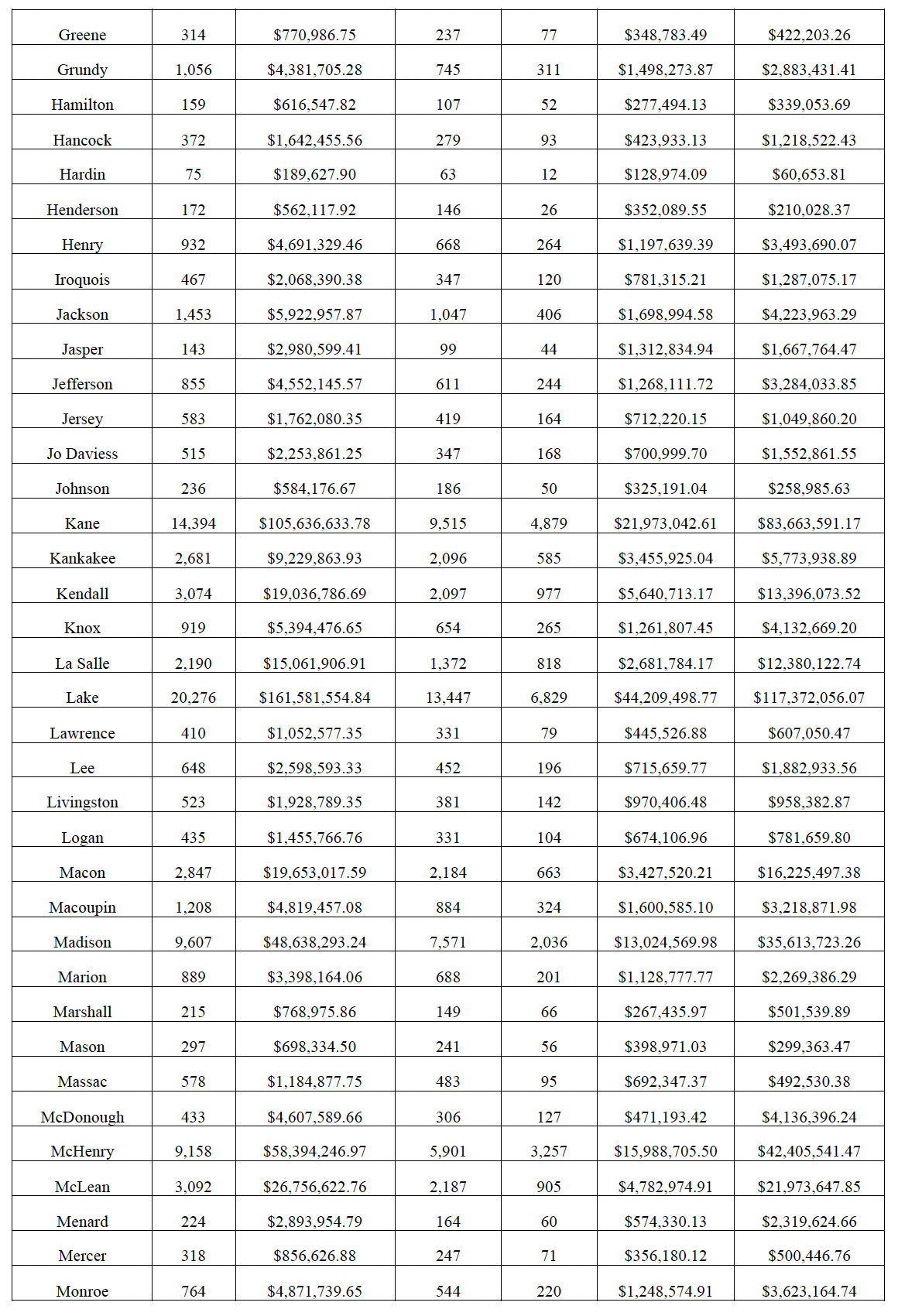

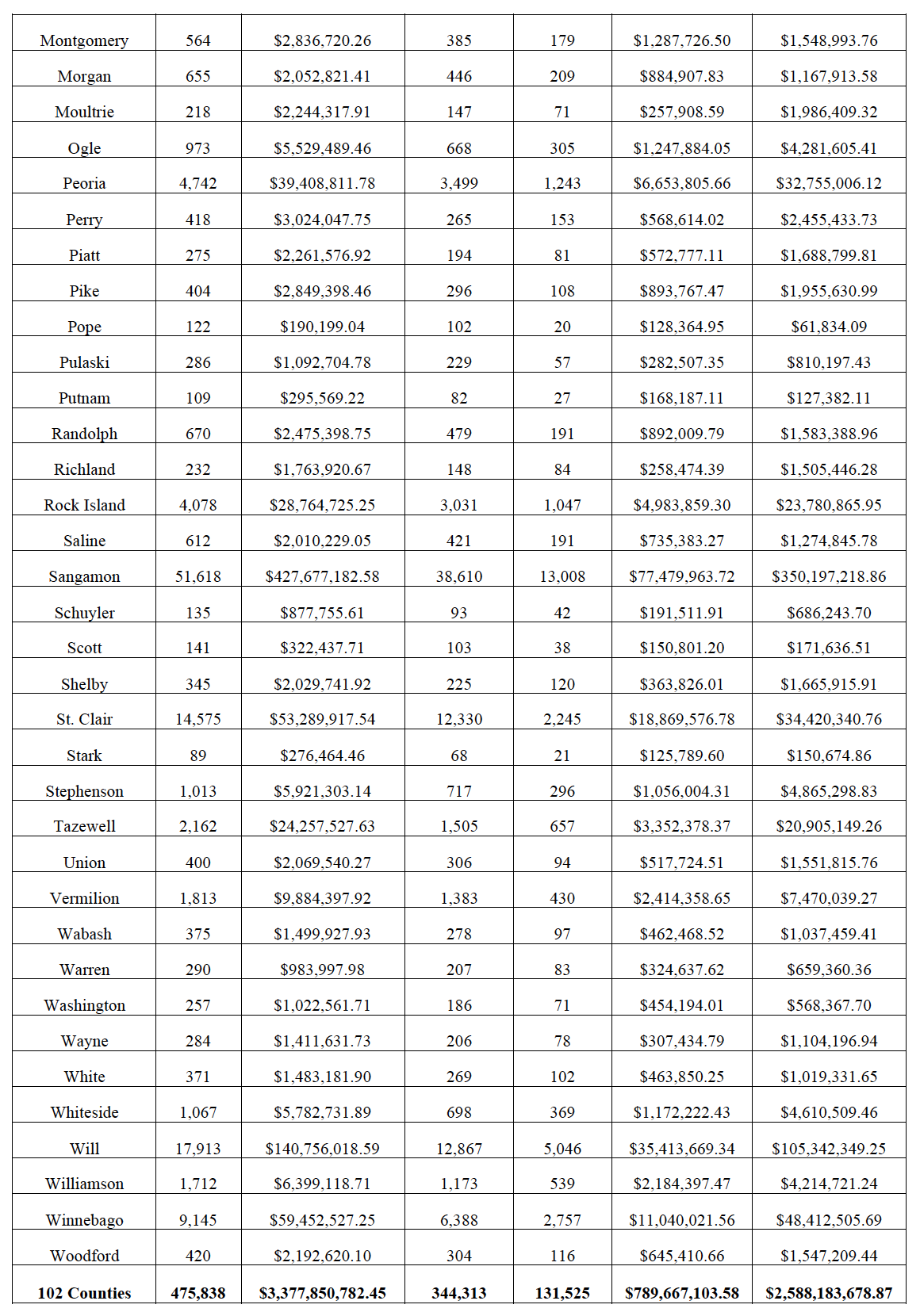

Arithmetic is the primary means whereby this essay determines how government liens, and their economic value in 2022 dollars, are distributed in Illinois over time.72 Such an approach relies on its “application of . . . addition, subtraction, multiplication and division” to a new government lien dataset, in order to make findings about these sub-national encumbrances in Illinois.73 Among this essay’s key findings is that there were 475,838 liens imposed on debtor-citizens between Fiscal Years 1994 and 2020, which had a combined economic value of $3,377,850,783.74 An equally important secondary finding is these liens, along with their related economic values, are distributed on an unequal (i.e., skewed) basis: at least in cases wherein debtors are divided up based on whether they are an individual or business.75

This essay’s approach also may yield a range of other useful insights, especially if combined with other information that is collected in the normal course of Illinois business. For example, these combined data may help to determine the total amount of uncollected revenues over time.76 This information also is capable of creating standard units for comparing the cost of government liens, whether in a single Fiscal Year or over time.77 Finally, these combined data may be publicly disseminated: in order to determine if current government lien policies and practices are understood to be optimal.78

It must be recognized, however, that such an approach may not provide many useful insights in the presence of methodological issues.79 As such, this essay takes pains to identify and limit any such issues.80 And if successful, every one of these key issues will be identified and overcome.81

For example, this essay may limit selection effects by focusing on the twenty-six (26) years of government lien information that were collected prior to the COVID-19 pandemic.82 It also could reduce the possibility that sampling error, whether such error is systematic or merely one-off, will arise from reliance on public information that collected in the normal course of Illinois business.83 Other issues may be avoided by using standard units.84

V. Positive Analysis

As stated previously, this essay applies arithmetic to a new DOR dataset, so as to find out who gets subjected to government liens in Illinois.85 By doing so, it initially finds that 475,838 liens were imposed between 1994 and 2020.86 These 475,838 liens had an economic value of $3,377,850,783 in 2022 dollars.87 In the following, additional findings will be highlighted that could help to identify a more optimal basis for government lien imposition.88

This essay, for example, finds that government liens have been distributed on a skewed basis.89 It specifically finds that most liens are imposed on individual debtors, as opposed to business ones, during the study period.90 72% of the 475,838 liens were placed on in-state properties owned by individual debtors,91 whereas 28% were for business-owned properties.92

One potential explanation for this skewed result is that individuals which are more numerous than businesses over the last 26 years.93 Another possibility is that individual debtors may face more lien-eligible situations than business ones.94 A third explanation is that Illinois may apply different lien imposition and enforcement standards, based on whether the debtor is an individual or a business, due to the fact governments often hold different groups to distinct standards.95 Regardless of which explanation proves to be true, more research is needed to find out why individuals debtors are subjected to more liens than businesses debtors in this essay’s study period.96

This essay also finds that most lien debt is owed by business debtors, rather than by individual ones, which flies in the face of the conventional wisdom that governments should be run like businesses.97 Business debtors owed 77% of the $3,377,850,783 in lien-eligible debt owed to Illinois from 1994 to 2020.98 Individual debtors are responsible for the remaining 23%.99

This second skewed result may be explained by the fact that businesses have many more reasons to avoid paying their debt, in comparison to individual debtors, since late payments often serve as hidden subsidies that may conceal business losses.100 Another potential explanation is business debtors could have different views about the morality of paying late than individual debtors.101 A final possibility is that Illinois may view late payments by business debtors as less blameworthy than late payments by individuals.102 In any event, more research is needed. Among the questions that need to be answered is “why are business debtors more delinquent than individual debtors, despite smaller numbers and fewer lien eligible debts?”103

VI. Normative Analysis

Assuming that this essay’s findings are substantiated by subsequent research, which also indicates that business debtors may be treated better than individual ones with respect to lien imposition during the study period,104 “what are the possible reasons for less-than-standard treatment of otherwise similarly situated debtors?” Perhaps unequal treatment arises from the fact that a majority of liens have been imposed on individual debtors, as a group, for as long as Illinois has been collecting aggregate-level data on these encumbrances.105 So, in other words, the relatively small number of liens imposed on businesses may lead the state to focus on individuals over time.106

Within this context, it is somewhat understandable that individual debtors are more likely to be subject to lien imposition and enforcement.107 Whereas similarly situated business debtors are treated better without adequate justification.108 If it is substantiated by follow-up research, this anticipated unequal treatment is likely to undercut confidence in creditor-states and invite challenges under the Fifth or Fourteenth Amendments.109

As such, unjustified differences in debtor treatment should be limited to avoid potential constitutional violations and subsequent litigation.110 Especially in light of the fact that Illinois business debtors, as a group, owe substantially more in government lien debt than individual debtors do.111 A good way to limit unequal treatment is by examining the status quo and determining if discretion may arise from a sub-optimal informational basis.112

Illinois could assure perfect equality of treatment, at least as between individual and business debtors, by promptly taking action against anyone that meets the qualifying conditions to have a government lien imposed and/or enforced against them.113 Every such filing should be made on a date that is set by rule, which assures that the term “delinquency” is more closely tied to the amount of time that a debt has gone unpaid.114 By doing so, Illinois makes use of a better informational basis for lien imposition/enforcement: the actual conduct of citizen-debtors that are subjected to government liens.115

The reason that this basis is superior to the status quo, and perhaps could prove to be the optimal one for imposing government liens, arises from the fact that irrelevant information about the past payment histories of non-parties is not used to make lien imposition or enforcement decisions.116 This alternate informational basis may be considered better than the status quo, and perhaps markedly so, for another reason: it makes use of a more objective standard (i.e., firsthand observations about a debtor-citizen’s conduct) rather than a more subjective one (i.e., secondhand information about how a debtor-citizen may act, such as projections that are informed by potentially-irrelevant data).117 In other words, this modest change in informational basis limits the risk of arbitrary decision-making that could run afoul of the law.118

In the event that Illinois does not choose to protect its right to prompt payment by making this modest change, it could use a related but different approach to government lien reform.119 For example, this creditor-state could sell its right to enforce certain liens with economic values that exceed a minimum threshold amount.120 Illinois could also decide to change the way that government liens are handled prior to lien imposition or enforcement.121

A viable option may be to change what serves as the trigger for lien imposition and enforcement.122 Among the many ways that a creditor-state may do so is by requiring, once again, perfect equality of treatment.123 The easiest way to do so is by setting clear rules and preventing the exercise of any discretion.

One example of how Illinois could limit discretion and set clear rules, thereby assuring that similarly situated debtors get standard treatment, is if:

1. This creditor-state sends an email message to each and every debtor-citizen, once their delinquency is equal to 10% of the assessed value of their in-state property, which explains what may happen if their debt is not paid in a reasonable amount of time.124

2. This creditor-state sends an email message to each and every debtor-citizen, which announces the loss of certain public goods and/or services, such as Illinois Small Business Grants, once a debtor-citizen’s delinquency equals 25% of the assessed value of their in-state property. This email also explains what may happen if their debt is not paid off within a reasonable amount of time.125

3. This creditor-state sends a certified letter to each and every debtor-citizen, which announces the potential imposition of a government lien once a debtor-citizen’s delinquency equals 50% of the assessed value of their property. This mailing also may explain what happens if their debt is not paid in a reasonable amount of time and/or a payment arrangement is not requested.126

4. This creditor-state sends a certified legal notice of its intent to assign its government lien to a third party, or its intent to enforce the lien itself, once a debtor-citizen’s delinquency is equal to 75% of the assessed value of their in-state property. This mailing also may explain what happens if this seriously delinquent debt is not paid off before entry of a final judgement, a payment arrangement is not negotiated or a settlement is not agreed to in short order.127

5. This creditor-state sends a second certified legal notice of its assignment of its government lien to a third party, or enforcement of its lien, once a debtor-citizen’s delinquency is equal to more than 75% of the assessed value of their in-state property. This mailing also may describe the legal effect of an assignment, or enforcement of the lien, and provides a summary of the legal options that may be available prior to entry of a final judgment.128

VII. Conclusion

In the event that Illinois decides to embrace any of the aforementioned options, it also may want to take the following steps. First, ensure successful implementation of every desirable reform.129 For example, this state may do so by publicly explaining why it pursued changes to how it deals with liens.130 These reasons may include the fact that there were a range of unintended consequences, including possible unequal treatment of its citizen-debtors.131

Next, Illinois could tell each of its debtors that “public officials owe a fiduciary duty to act in … [the] … best interest … [of its actual tax-paying citizens].”132 As such, it would be a breach of duty to prioritize the interests of debtor-citizens that do not pay what they owe to this creditor-state.133 Such a statement may clarify its legal obligations, while limiting moral hazard.134

Lastly, Illinois should explain the aforementioned reasons to other interested parties such as government lien investors.135 Such an explanation could help these unrelated third parties to better understand the government lien imposition and enforcement process, which may help to direct attention to the negative impact that abusing this process has on their fellow citizens.136 By doing so, Illinois could encourage more socially beneficial behavior.137

Appendix

Table 1: All 102 Illinois Counties138

* Professor of Law, University of Missouri-Kansas City, School of Law. Special thanks to Dean Lumen Mulligan, Professor Barbara Glesner-Fines, Ms. Kristen Carney and Cubit Planning. Additional thanks are due to UMKC’s Publication Grants Program.

1. See 94-Year-Old Grandmother Fights Home Equity Theft In Minnesota: Tyler v. Hennepin County, Pacific Legal Found., https://pacificlegal.org/case/mn_home_equity_theft/ (last visited July 24, 2023), [https://perma.cc/V2LU-LL2H] (describing facts in this case).

2. Id.

3. Id.

4. Id.

5. See Tyler v. Hennepin County, 26 F 4th 789 (8th Cir. 2022) (describing initial lawsuit).

6. Surplus Value, Collins Dictionary, https://www.collinsdictionary.com/us/dictionary/english/surplus-value (last visited July 24, 2023) [https://perma.cc/D5SU-V2SN] (explaining the term to mean “the amount by which . . . [a thing’s value exceeds what is paid for it].”).

7. See generally Pacific Legal Foundation, supra note 1.

8. Id.

9. See Tyler v. Hennepin County, 143 S.Ct. 1369, 1380–81 (2023) (awarding this plaintiff damages in the amount of $25,000 under the Takings Clause of the Fifth Amendment).

10. Id. at 1381.

11. Id. at 1376.

12. The Pacific Legal Foundation, among other groups, has undertaken some of this work. See, e.g., Pacific Legal Foundation, New Report Shows Tax Laws In Several States Allow Home Equity Theft (Nov. 29, 2022), https://pacificlegal.org/press-release/report-shows-tax-laws-in-several-states-allow-home-equity-theft/ [https://perma.cc/P4F4-V3M3], which describes in detail:

the first national study to expose the injustice of home equity theft through tax foreclosure . . . [,] . . . that 12 states and Washington D.C. have laws on the books that regularly allow local governments or private investors to take dramatically more than what is owed from homeowners who are behind on their property taxes . . . [and] . . . that there are ten more states . . . [including Illinois] . . . that protect home equity in the foreclosure process but provide loopholes to governments or private entities to seize excess equity value that should belong to the . . . [debtor-citizen].”).

U.S. governments, such as Illinois, also undertook additional research that identifies inefficiencies in lien imposition or enforcement. This research led to important reforms. See, e.g., Lizzie Kane, Illinois Legislature Sends Bill Reforming Property Tax Sale System To Gov. J.B. Pritzker, Chicago Tribune (May 25, 2023), https://www.chicagotribune.com/business/ct-biz-property-tax-reform-bill-passes-2023-20230525eshqnlmlb5h5xippgomo6otbdm-story.htmlutm_source=newsletter&utm_medium=email&utm_campaign=Breaking%3A%20News-%20%2B%20Business&utm_content=5031685041212 [https://perma.cc/7VPZ-3WT8], explaining that:

A study from the treasurer’s office . . . found a small number of private investors were exploiting the system using a ‘sale in error’ loophole to undo . . . [government lien sales] . . . and recoup their investment, plus interest. The ‘sale in error’ process was created to reverse tax sales that should never have occurred, such as those in which the property owner already paid the taxes before the sale . . . investors have used the provision to argue that sales should be voided because of minor discrepancies in government records, such as saying a home had no air conditioning when it did, or a house had stucco when it was made of brick. When a sale in error is made, the treasurer’s office repays the investors, including up to 1% interest per month and fees that accumulated over the time they held the . . . [government lien] . . . These loopholes drain $40 million a year from local government coffers, often in Black and Latino neighborhoods where the properties are located . . . In a study examining sales in error between September 2015 and September 2022, . . . [Illinois] . . . found a total of $277.6 million, including at least $27.7 million in interest, was . . . [given to investors that purchased government liens then sought a sale in error].

13. One such question is whether creditor-states that have not attempted to convert any of their debtor-citizens’ surplus value still may be inefficient in other important ways. See generally Pacific Legal Foundation, End Home Equity Theft, https://homeequitytheft.org/ (last visited July 24, 2023) [https://perma.cc/482Y-TD7V] (explaining that “8950 homes and more than $860 million in life savings were lost to . . . [homeowners due to the process used for forced sales, after foreclosure, in Illinois].”).

14. Id. One example of a case in point is Illinois, which despite adhering to the majority legal rule for how to treat the surplus value from a foreclosure sale, still had suboptimal results: including the fact that 53% of all U.S. foreclosures took place in this jurisdiction.

15. Id. One example of how this essay could do so is by providing comparative analyses.

16. Id. (providing a graph that highlights the fact Illinois had 4,719 foreclosures by creditors, which generated almost $400 million in losses for debtors, from 2014 to 2021).

17. Compare 735 ILCS 5/15-1512 (describing the rules for turning over surpluses in Illinois), with Adam Liptak, States Are Not Entitled To Windfalls In Tax Disputes, Supreme Court Rules, N.Y. Times (May 25, 2020), https://www.nytimes.com/2023/05/25/us/supreme-court-condo-taxes.html [https://perma.cc/9NCZ-AMWM] (explaining that “retaining the entire value of a confiscated property, even when the debts owed amounted to a small portion of it, is authorized by Minnesota law . . . [But] . . . Minnesota’s approach is a relative outlier . . . ‘Thirty-six states and the federal government require that the excess value be returned to the taxpayer.’”).

18. Id.

19. Cf. National Association For The Advancement Of Colored People (NAACP) Legal Defense Fund, Economic Justice Case: Tax Lien Sales (Feb. 16, 2018), (explaining that:For decades, jurisdictions across the country have sold tax liens on properties with delinquent property taxes as a means to collect the debt owed—even when that debt is only a couple hundred dollars. Each jurisdiction applies this system differently, but, generally, where there are delinquent property taxes, a local government may sell a tax lien on that property to a third-party purchaser, who then has the right to collect the . . . [value of the] . . . tax debt from the property owner, in addition to interest and fees.)

20. See 35 Ill. Comp. Stat. 200/21-5 et seq.) (policies and procedures for imposing, and enforcing, government liens).

21. See generally 35 Ill. Comp. Stat. 200/21-110 (tax collector).

22. Id.

23. See Illinois Tax Lien Certificates And Tax Deeds, Tax Lien University (2022) https://taxlienuniversity.com/tax-sales/illinois-tax-lien-certificates-and-tax-deeds.php (last visited July 24, 2023) [https://perma.

cc/RES5-R8QY].

24. Id. (explaining that “Illinois is unique in that it holds two types of tax sales; regular Illinois tax lien certificate sales and Scavenger tax sales.”).

25. Cook County Treasurer, Annual Tax Sale Background Information (June 13, 2022), https://www.

cookcountytreasurer.com/annualtaxsalebackgroundinformation.aspx [https://perma.cc/Y4XS-E2VM].

26. Id.

27. See, e.g., Andrew W. Kahrl, Capitalizing On The Urban Fiscal Crisis: Predatory Tax Buyers In 1970s Chicago, 44 J. Of Urb. History 382-401, 387 (2018) (explaining that: Vague state guidelines and lack of oversight allowed local assessors to abuse their . . . legal . . . powers with . . . impunity. While the state of Illinois mandated that . . . [officials] . . . assess property at fair cash value, it provided no guidelines for determining fair cash value, and no state supervision of local assessors . . . As a result, . . . [local] . . . assessors were free to interpret these guidelines as they pleased . . . [and to increase the risk that certain Illinois homeowners would be subjected to government liens in bad faith].”).

28. Cf. Tyler v. Hennepin County, 143 S.Ct. 1369, 1380–81 (2023).

29. See generally Pacific Legal Foundation, supra note 1.

30. It is well-established that foreclosure rates vary for debtors, even similarly situated ones, based upon irrelevant considerations such as a debtor’s physical characteristics. See generally Matthew Hall, Kyle Crowder, and Amy Spring, Variations in Housing Foreclosures by Race and Place, 2005–2012, ANNALS Am. Acad. Pol. and Soc. Sci., June 9, 2015, at 660 (explaining that a “study describes the spatial and racial variations in housing foreclosure during the recent housing crisis . . . The crisis was patterned sharply along racial/ethnic lines, with metros and neighborhoods with large Black and Latino populations—as well as racially mixed neighborhoods—having high rates of foreclosure . . . The race-stratified . . . patterns of foreclosure revealed . . . are substantially more complicated than a narrative that depicts only the unique disadvantage of Black households . . ., and likely reflect some level of . . . targeting of minority populations and neighborhoods by predatory . . . lenders.”)

31. See generally American Bankruptcy Institute, Consumer And Non-Consume Business Debt In Bankruptcy, https://abi.org/feed-item/consumer-and-non-consumerbusiness-debt-in-bankruptcy (last visited July 24, 2023) [https://perma.cc/6S7D-RX7H] (explaining that “Section 101(8) of the Bankruptcy Code defines a consumer debt as “debt incurred by an individual primarily for a personal, family, or household purpose.” Many bankruptcy courts have developed a “profit motive” test. If the debt was incurred with an eye towards making a profit, then the debt should be classified as business debt.”). Cook County, among other jurisdictions, too often, has favored businesses over individual citizens without “clout.” See Kahrl, supra note 28, at 387 (explaining that “Cook County assessor P.J. Cullerton . . . rewarded large corporations and allies of the Daley machine with generous tax breaks.”).

32. A similar phenomenon is observed with respect to taxes. Id. at 389, explaining that:

Caught between the desire to retain middle- and upper-income homeowners and businesses through favorable tax assessments and the need for revenue, assessors turned to their city’s poorest, most expendable, and least mobile taxpayers. In fiscally distressed cities, assessors found themselves under enormous pressure not to adjust assessments downward on properties in neighborhoods with high rates of tenancy, where the effects of higher-than-average property taxes were less apparent to this segment of voters.

33. Compare Tyler v. Hennepin County, 143 S.Ct. 1369, 1380–81 (2023), with Brittany Hunter, After Losing His Wife, A Nebraska Man Lost His Home To An Unconstitutional State Tax Scheme (Apr. 7, 2023), https://pacificlegal.org/man-lost-his-home-unconstitutional-state-tax-scheme/ [https://perma.cc/QQ3E-F2DQ] (describing a similar case, which was stayed pending the resolution of Tyler).

34. Id. (explaining that “The Constitution is clear that a government cannot take a person’s property without just compensation . . . [and a valid justification such as putting it to a public use].”).

35. See Kahrl, supra note 28, at 389, explaining that:

Although often invisible to the individual taxpayer, the tax breaks enjoyed by businesses, industries and owners of higher-value residential properties bore a direct relation to the onerous tax burdens shouldered by the poor and working class in other ways too. A city’s property tax base is the sum of all assessed values on properties. The amount of money a city needs divided by its tax base determines the tax rate for all property owners. Assuming a city’s budgetary needs remain constant, for each property that is undervalued, the tax rate for everyone rises. The proportion of the city’s budget paid by each property owner depends on the assessed valuations of all other properties . . . [that are not relieved of their obligation to pay a fair share].

36. Id., explaining that:

Higher than average tax bills in downwardly transitional neighborhoods were not simply unfair. They also had a perverse effect on local real estate markets. For rental units, high assessments lowered property values, as the reduced cash flow was capitalized into lower market price. This, in turn, gave rise to a class of well-connected and deep-pocketed investors who bought over-assessed properties, appealed the assessment (citing the purchase price as evidence of diminished value), and then, upon securing a reduced assessment, resold for a modest profit.

37. See generally Ill. Dep’t Revenue (IDOR), Response To Freedom Of Information Act Request found at Randall K. Johnson, Illinois Government Liens – 2020 Dataset – Computations (2022) (unpublished data set) (on file with author) (describing the actual distribution, and economic value, of Illinois government liens in the 26 year period between 1994 and 2020).

38. See generally Randall K. Johnson, Ella P. Stewart And The Benefits Of Owning A Neighborhood Pharmacy, 8 Adm. L. Rev. Accord 101 (2023) (explaining how to find out the distribution of certain public goods and/or services that are dispensed by pharmacists on behalf of U.S. governments); See generally Randall K. Johnson, Why Illinois Should Reevaluate Its Video Tolling Subsidy, 106 Iowa L. Rev. 2303 (2021) (explaining, in part, the distribution of a specific transportation subsidy in Illinois).

39. See Johnson, supra note 39, at 2308 (asking, and answering, the question of “how much does it cost Illinois when transponder users fail to pay their tolls in real time . . . The minimum cost turns out to be $9,535,974.”).

40. Id. at 2315 (explaining that “requiring valid justifications . . . potentially has positive and normative implications. If . . . evaluated on conventional economic efficiency grounds, for example, it . . . [is clear if a policy] . . . is cost-justified.”).

41. See, e.g., Randall K. Johnson, Frederick Douglass And The Hidden Power Of Recording Deeds, 95 S. Cal. L. Rev. Postscript 54 (2022) (explaining, in part, how information collected in the normal of recording deeds limit unlawful activities that disproportionately impact Black American property owners).

42. See, e.g., Johnson, supra note 38, at 2316 n.50 (explaining that “follow-up research could build on the approach described in this paper, or in earlier works, which used regression or other more complex empirical methods to make findings about whether . . . [specific public policies] . . . are cost justified in distributional equity terms.”).

43. See, e.g., Randall K. Johnson, How Mobile Homes Correlate With Per Capita Income, 11 Cal. L. Rev. Online 91 (2020) (explaining, in part, the distribution of mobile homes in Illinois):

This study seeks to further interrogate its sole research question. Specifically, the goal is to further establish whether and how mobile homes may correlate with per capita income by substituting the ‘licensed mobile home parks’ proxy variable with the ‘licenses mobile home parks’ proxy variable.

44. Id. at 101 (describing how mobile homes, mobile home parks and per capita incomes, are distributed among the 102 Illinois counties).

45. Id. at 99–100, explaining that:

Illinois should find out whether non-economic considerations created a substitution effect with respect to affordable housing and if it has a disparate impact by race or ethnicity. Among . . . policies that could explain such impacts are the salience of mobile homes as an affordable housing option, the preferential tax treatment that mobile homes historically received and the current ban on local rent control.

46. See infra Table 1. Optimality, at least for purposes of this essay, means “a well-defined balance among multiple criteria.” Milan Zeleny, Eight Concepts of Optimality. In Joao Clímaco (ed.), Multicriteria Analysis (1997), https://doi.org/10.1007/978-3-642-60667-0_19.

47. See 35 Ill. Comp. Stat. 200/21-5 et seq (2022) (current government lien laws); See Public Act 100-22 (2020), https://www.ilga.gov/legislation/publicacts/100/100-0022.htm [https://perma.cc/S5JS-QML8] (describing the changes to state property law, including lien law, which are part of a 2020 revenue bill).

48. See Ill. Legal Aid Online, Enforcing Judgment Liens Against Real Estate (May 24, 2020), https://

www.illinoislegalaid.org/legal-information/enforcing-judgment-liens-against-real-estate [https://perma.cc/39D

8-KXWU] (explaining that “In Illinois, a court judgment must first be recorded with the Recorder of Deeds in the county where the property is located.”).

49. Id.

50. Id. (explaining that “[e]nforcing or foreclosing on the judgment lien is done the same way as a mortgage foreclosure.”).

51. Id. (explaining that “creditor will record a notice of foreclosure with the county’s Recorder of Deeds . . . A noticer of the foreclosure action will also be published in the local newspaper once a week, for three consecutive weeks, at least 30 days before a judgment of foreclosure is entered by the court.”).

52. Id., explaining that:

Motions for turnover . . . have . . . [three (3)] . . . requirements: . . . [1.] . . . The judgment must be greater than . . . [the debtor citizen’s] . . . equity interest. Equity interest refers to the value of the home minus what . . . [the debtor citizen owes] . . . [2.]. . . The creditor . . . [government] . . . must repay any mortgages on the property before . . . [subtracting what it is owed by the debtor citizen from] . . . the proceeds . . . [and 3.] . . . if the property . . . is . . . [the debtor citizen’s primary residence, it is subject to the Homestead Exemption and this defense may prevent the property] . . . from being sold if . . . [the debtor citizen’s] . . . equity interest . . . is less than the exemption amount.

53. Id.

54. Id.

55. Id. (explaining that “if the creditor decides to enforce the judgment lien, he will do a title search . . . to find any other liens on the property. The parties with those liens also will be named as defendants in the foreclosure complaint.”).

56. See 735 Ill. Comp. Stat. 5/515-1504 (Foreclosure pleadings and service).

57. Id.

58. Id.

59. See Ill. Legal Aid Online, supra note 48.

60. Id.

61. Id.

62. Id.

63. Id.

64. Id.

65. Ill. Legal Aid Online, supra note 48.

66. Id.

67. Id.

68. Id.

69. See Ill. Legal Aid Online, supra note 48.

70. Id.

71. Id.

72. See Ill. Dep’t Revenue, supra note 37 (describing the actual distribution, and economic value, of Illinois government liens between 1994 and 2020). IDOR also provides other relevant and probative information about government liens, which is current as of January 2021, through its newly created State Tax Lien Registry.

73. Arithmetic, Merriam-Webster, https://www.merriam-webster.com/dictionary/arithmetic [https://

perma.cc/4V8Q-E7DY].

74. See infra Table 1.

75. Id.

76. Cf. Johnson, supra note 38, at 2313 (explaining that “arithmetic is helpful in evaluating Illinois’ level of investment.”).

77. Id. (explaining that arithmetic is a straightforward way to create “a standard unit for potentially comparing . . . public investments.”).

78. Although some critics allege that government officials’ knowledge is partial and, too

often, misused. Cf. Gary M. Galles, Why Government Officials Must Routinely Fudge Basic Arithmetic, Fee Stories (Mar. 24, 2019), https://fee.org/articles/why-government-officials-must-routinely-fudge-basic-arithmetic/ [https://perma.cc/2CRS-TP6D], (explaining that “this standard unit provides a valid metric to determine if such a high level of public investment should continue going forward.”).

79. Cf. Johnson, supra note 38, at 2313 (explaining that “arithmetic, however, may not prove as useful if certain issues have been introduced.”).

80. Id.

81. Id.

82. Compare Ill. Dep’t Revenue, supra note 37, with infra Table 1.

83. Id.

84. Id.

85. See infra Table 1.

86. See infra Table 1.

87. Id.

88. See infra Table 1.

89. See generally James Chen, Skewness, Investopedia (June 15, 2022 updated Mar. 31, 2023), https://

www.investopedia.com/terms/s/skewness.asp [https://perma.cc/7UX8-5Y64] (explaining that “skewness refers to a distortion or asymmetry that deviates from the symmetrical bell curve, or normal distribution, in a set of data. If the curve is shifted to the left or to the right, it is said to be skewed.”).

90. See infra Table 1.

91. Id. (describing how 344,313 of the 475,838 government liens are imposed on individuals between 1994 to 2020, which is about 72% of this population total).

92. Id. (describing how 131,525 of the 475,838 government liens are imposed on individuals between 1994 to 2020, which is about 28% of this population total).

93. See Historical Population Change Data (1910-2020), United States Census (US Census) (Apr. 26, 2021), https://www.census.gov/data/tables/time-series/dec/popchange-data-text.html [https://perma.cc/3QU9-3CPW] (explaining that Illinois had 12,812,508 residents in 2020, where this state only had 11,430,602 in 1990); Compare Stanley Ziemba, No Loss Of Illinois Jobs, Firms-In 1990, That Is, Chicago Tribune (Dec. 17, 1992), https://www.chicagotribune.com/news/ct-xpm-1992-12-17-9204240715-story.html [https://perma.cc/M5YZ-T2LJ] (explaining that, in 1990, “the number of Illinois businesses increased 1.7 [%], to 272,738.”), with Illinois.gov, Illinois Emerges As Regional And National Leader In Startup Creation in 2021, Ill. Dep’t Com. econ. Opportunity (DCEO) Press Release, (Feb. 4, 2022), https://www.illinois.gov/news/press-release.24480.html [https://perma.cc/CX52-MBTS] (explaining that from “2019 to 2020 there was also a 45% increase in business startups 117,392 to 170,400”).

94. Among the activities that are listed as lien-eligible, at least between 1994 and 2020, are: Sales Tax, Automobile Rental Tax, Bingo Tax—Operator, Bingo Provider’s License, Bingo Supplier’s License, Business Income Tax, Cigarette Use Tax-Distributor, Cigarette Tax-Distributor, Cigarette Use Tax, Char Games Tax-Operator, Char Games Provider’s License, CMFT-1 County Motor Fuel Tax, Business Composite Tax, Coin-Operated Amusement Device Tax, Dry-Cleaning—Operator, Dry-Cleaning Solvent Tax, Electricity Excise Tax, Gas Revenue/Gas Use Tax, Electricity Dist. & Inv. Cap Tax, IFTA Application, IFTA Returns, Individual Income Tax, Live Adult Facility Surcharge, Liquor Tax-Direct Wine Shipper, Liquor Tax-Importer/MFTR/Distr., Med. Cannabis Cultivation Tax, Motor Fuel Tax—Alt. Fuels, Motor Fuel Tax—Distributor, Motor Fuel Violations, Motor Fuel Tax—Supplier, Motor Fuel Tax—Receiver, Parking Excise Tax, Prepaid Sales Tax, Pass-through Entity Income Tax, Pull Tabs Tax—Operator, Qualified Solid Waste, LSE Use Tax, Vehicle Tax, Aircraft/Watercraft Tax, Hotel Operators Occupation Tax, Rental Purchase Agreement Occupation Tax, Chicago Soft Drink Tax, Use Tax, Aviation Fuel Sale Tax, Sales/Use Tax & E911 Surcharge, Food & Beverage Tax, MPEA, Tire User Fee, Telecommunications Excise Tax, Telecom Infrastructure Maintenance Fee, Tobacco Products Tax and the Withholding Income Tax. See Freedom Of Information Act (FOIA), Illinois Department Of Revenue, https://www2.illinois.gov/rev/aboutidor/foia, (response to request for Illinois Department of Revenue data including a full list of debts eligible for government liens).

95. See Paul Krugman, Why Do The Rich Have So Much Power?, N.Y. Times (July 1, 2020), https://

www.nytimes.com/2020/07/01/opinion/sunday/inequality-america-paul-krugman.html [https://perma.cc/3DPB-9HTK] (explaining that, in discussing related cognitive biases, the U.S. tendency to be overly deferential to higher-income people “reflects . . . factors, like the (often false) belief that people who’ve made a lot of money have special insight into how the nation . . . can achieve prosperity.”).

96. See infra Table 1.

97. Id.

98. Id. (describing how government liens imposed on businesses had an economic value of $2,588,193,678.87 between 1994 to 2020, which is about 77%).

99. Id. (describing how government liens imposed on individuals had an economic value of $789,667,103.58 between 1994 to 2020, which is about 23%).

100. See generally Sarah Kuta, When It Makes Sense To Pay Suppliers Late, Chi. Booth Review (Aug. 2, 2021), https://www.chicagobooth.edu/review/when-it-makes-sense-pay-suppliers-late [https://perma.cc/B5WJ-UYMG] (explaining that “companies often pay late, which helps them to manage cash and put pressure on suppliers to deliver high-quality goods and services on time . . . [while also putting] . . . suppliers in the position of acting as de-facto lenders.”).

101. See generally Nikita Aggarwal, The New Morality Of Debt, Int’l Monetary Fund’s Fin. And Dev. (2021), https://www.imf.org/external/pubs/ft/fandd/2021/03/new-morality-of-debt-aggarwal.htm (explaining that “throughout history, society has debated the morality of debt . . . These concerns continue to influence . . . lending and . . . credit markets.”).

102. See generally Unnamed Columnist, What Is The Morality Of Debt?, Reuters (Oct. 26, 2011), https://www.reuters.com/article/idUS405682370420111026 [https://perma.cc/JX5X-5MWW ] (explaining that “The American moral debate . . . [about debt] . . . is as old as George Washington.”).

103. Compare Illinois Department Of Revenue, supra note 37, with infra note at Table 1.

104. When this essay’s data on the number of government liens in Illinois is properly contextualized using an admittedly back-of-the-envelope approach, for example, there are 5,059 (131,525/26) liens imposed each year on Illinois’ average annual number (272,738 + 170,400/2 = 221,569) of businesses between 1994 and 2020. The result is that one out of every 44 Illinois businesses were subjected to a lien between 1994 and 2020. In contrast, there were 13,243 (344,313/26) liens impose each year on Illinois’ average annual number (11,430,602 + 12,812,508/2 = 12,121,555) of residents during the same time period. The result is that one out of every 915 Illinois residents got subjected to a lien between 1994 and 2020. Thus, it is clear that potential business debtors got subjected to more government liens than potential individual debtors on a per capita basis over time. A related type of analysis may be undertaken for the value that is associated with the government liens that were imposed between 1994 and 2020. The average values that are associated with the 131,525 liens that are imposed on Illinois’ average number (221,569) of potential business debtors between 1994 and 2020, which was $99,545,526.10 on average over this essay’s study period ($2,588,183,678.87/26), totals $449.27 per potential business debtor. In contrast, the average value of the 344,313 liens that are imposed on Illinois’ average number (12,121,555) of potential individual debtors over the same time period, which was $30,371,811.70 on average between 1994 and 2020 ($789,667,103.58/26), totals $2.51 per potential individual debtor. Thus, it is clear that potential business debtors generated government liens with higher average values than the value of liens that were imposed on potential individual debtors. Both of these analyses may be good starting points for future work. See generally U.S. Census, supra note 93; Compare Ziemba, supra note 93, with Illinois.gov, supra note 93.

105. See Illinois Department Of Revenue, supra note 37.

106. See infra note at Table 1.

107. Id.

108. Id.

109. Cf. Pacific Legal Foundation, supra note 1 (invoking Fifth and Eighth Amendments).

110. Cf. Hunter, supra note 33.

111. See infra note at Table 1.

112. Cf. Johnson, supra note 38.

113. See generally Illinois Department of Revenue (IDOR), Collection Process (2023), https://tax.illinois.

gov/individuals/collection.html [https://perma.cc/B97C-GQE5] (describing current state policies).

114. Id.

115. Id.

116. Id.

117. Id.

118. Id.

119. Id.

120. Illinois Legal Aid Online, supra note 48.

121. Cf. Johnson, supra note 38.

122. Id.

123. Several other U.S. law professors have made more comprehensive reform proposals. See, e.g., Tracey Roberts, Weekly SSRN Tax Article Review And Roundup: Roberts Reviews Property Tax Privateers By Bradley & Baskett, TaxProfBlog (Aug. 20, 2021), https://taxprof.typepad.com/taxprof_blog/2021/08/weekly-ssrn-tax-article-review-and-roundup-roberts-reviews-property-tax-privateers-by-bradley-basket.html [https://perma.cc/

ER8U-L6NZ]. This review explains the benefits of the “big” reforms described by Bradley & Baskett:

[although the reviewer encourages reformers] . . . to go even bigger. A simpler, and possibly better, policy might be to exclude the tax liens on owner-occupied homes form bulk sales altogether. This would achieve the . . . goals of requiring politicians to take responsibility and remain accountable to their constituents for the consequences and political ramifications of their actions. Local governments would retain the ability to foreclose on the tax liens for these homes, but if these tax liens were removed from the bulk sale process, local governments would be forced to take a ‘hard look’ before proceeding with the foreclosure process. For economic reasons governments would also likely limit their foreclosure to those homes with high value tax liens and sufficient real property values to justify the foreclosure. This would limit the adverse impacts for several reasons . . . [all listed in the review].

124. In cases where this reform’s effectiveness is undercut by a digital divide, as between members of socially disadvantaged groups and more advantaged ones, then substitute performance could take the form of a letter that is mailed using delivery confirmation.

125. Id.

126. Id.

127. Id.

128. Id.

129. Cf. Johnson, supra note 38.

130. Id.

131. Compare 35 ILCS 200/21-5 et seq (2022) (describing current government lien laws) With Public Act 100-22 (2020) (describing the previous state of government lien laws).

132. David H. Hoffman & Juliet S. Sorensen, Public Corruption And The Law: Cases And Materials 49 (2017).

133. Cf. Johnson, supra note 38.

134. See generally The Economist, Second Degree Moral Hazard (Mar. 2, 2017), https://www.economist.

com/finance-and-economics/2017/03/02/second-degree-moral-hazard# (explaining “People behave differently if they do not face the full costs or risks of their actions: deposit insurance makes [bank] customers less careful.”).

135. Cf. Roberts, supra note 127 (describing the phenomenon of property tax privateers, which is a term used by Bradley & Baskett to describe some government lien investors).

136. Id.

137. Id.

138. Ill. Dep’t Revenue, supra note 37.

The full text of this Article is available to download as a PDF.